A recent survey provides marketing guidance for manufacturers.

- Log homes are appealing to both younger and older buyers and are used for a variety of purposes.

- Although the interest in log construction is driven primarily by aesthetics, most customers also want energy efficiency and will pay a slight premium for it.

- A growing number of these homes are hybrid construction, combining logs, timbers and even stick-built elements.

The magazine Log & Timber Home Living regularly conducts surveys of both consumers and businesses in the log and timber home industry. At the most recent National Association of Home Builders’ Building Systems Summit in October 2023, Editor-in-Chief Donna Peak gave a presentation on the results of their most recent surveys.

Close to 50 companies responded to the 2023 industry survey, and about 1350 respondents completed the consumer survey. Some of them were readers of the magazine; others accessed the survey through the magazine’s website, via social media and internet searches, or by other routes. The survey isn’t a random sample, but it does include people with varying levels of interest in log and timber homes.

In this article, we’ll talk about some of the highlights of the survey and we’ll also delve into some additional details that Peak didn’t cover in her presentation at the Summit.

Photo courtesy of James Ray Spahn

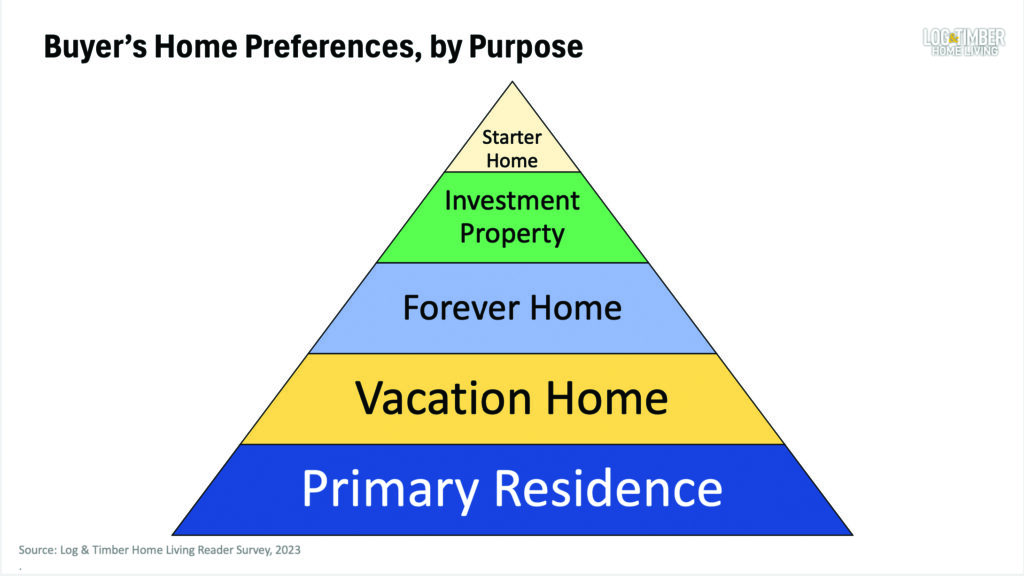

Function of the Homes

Log and timber homes aren’t just for holiday cabins; in fact, the survey identified five separate motivations that manufacturers can target when marketing their products. The biggest share of respondents — 43% — want a log or timber home as a primary residence, while just 22% want one as a vacation home. Another 18% want a ‘forever home’ (that is, the last home they plan to own, which might be a retirement home or a home they intend to pass down to their children). 10% want one as an investment property, 5% as a starter home and the remaining 2% weren’t planning to build a home.

Most customers want to live in the home year-round. And why do they want a log/timber home, rather than a conventionally built home? Because they like the aesthetic. Other things are important to them, but the main appeal is that they like the way they look.

Who Wants to Buy a Log/Timber Home?

Peak says that until recently, the major demographic interested in buying a log/timber home was older people who’ve grown up watching Bonanza and other TV shows and movies set in the West. These days, the interested demographic is younger — 54% are under age 45. And perhaps, Peak suggests, this is partly due to the popularity of the Yellowstone TV series, which first aired in 2018 and is still running. The show was filmed in Utah and Montana and, according to People magazine, the ranch house featured in the show is a real 5,000 sq. ft. log house on a real, 2,500-acre working ranch in Montana.

What Do Buyers Care About?

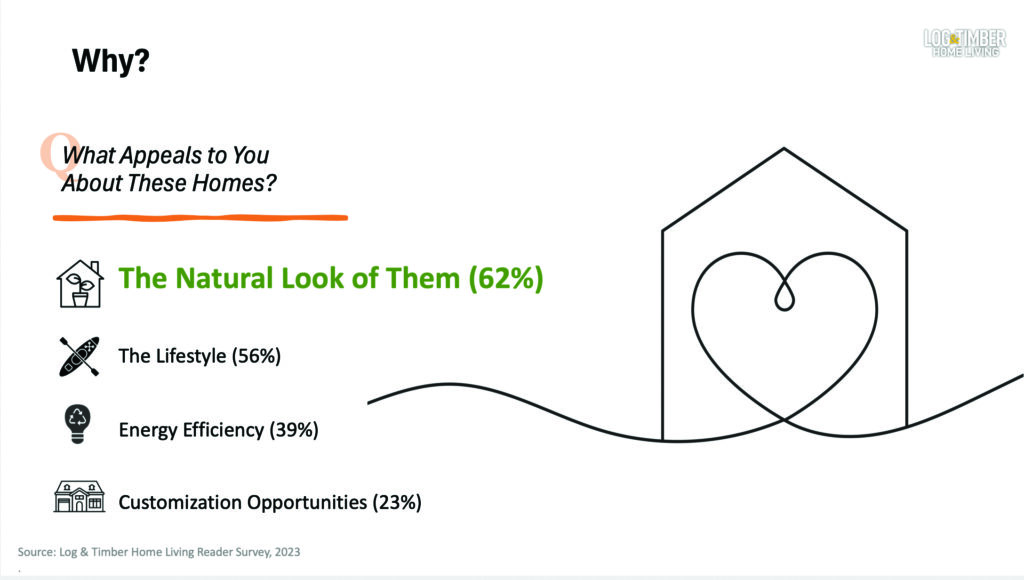

Peak suggests that sellers might sometimes be inclined to get into the nitty-gritty of their production processes too quickly, wanting to highlight their high-quality workmanship. And while this is important to consumers, it can scare them off at the beginning of the process. The first thing to do is to appeal to their aesthetic sense — they love the natural wood look of log and timber homes. In fact, 62% of consumer respondents say that it’s the natural look of the homes that appeals to them.

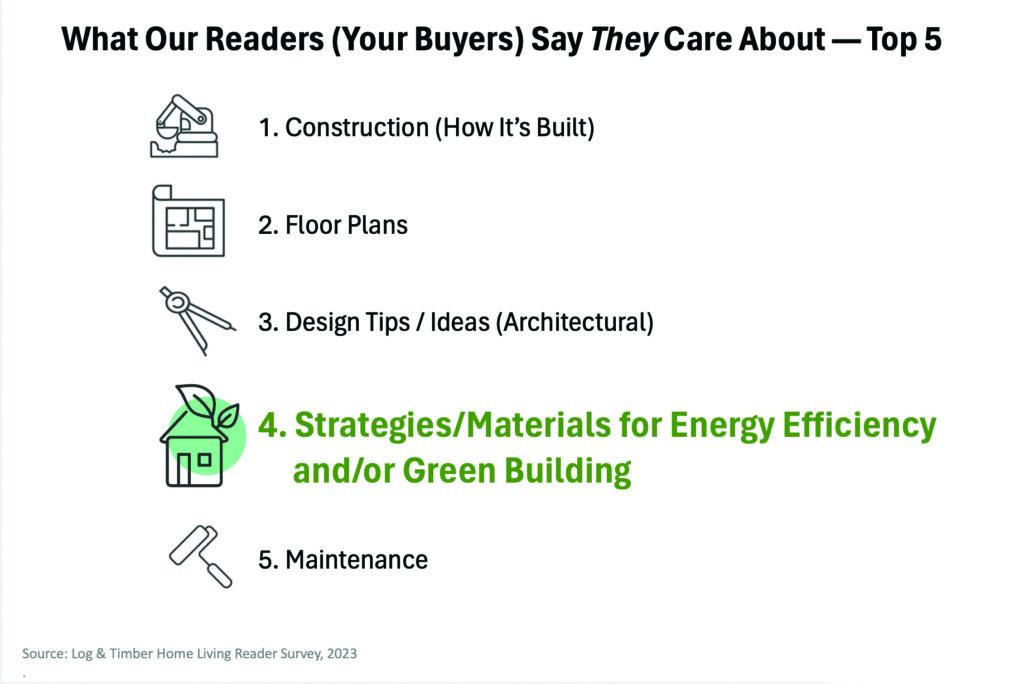

Once they’re hooked on what you can provide aesthetically, then it’s time to dig into other details. And what details are they most interested in? First, they want to know about the home’s construction, how it’s built.

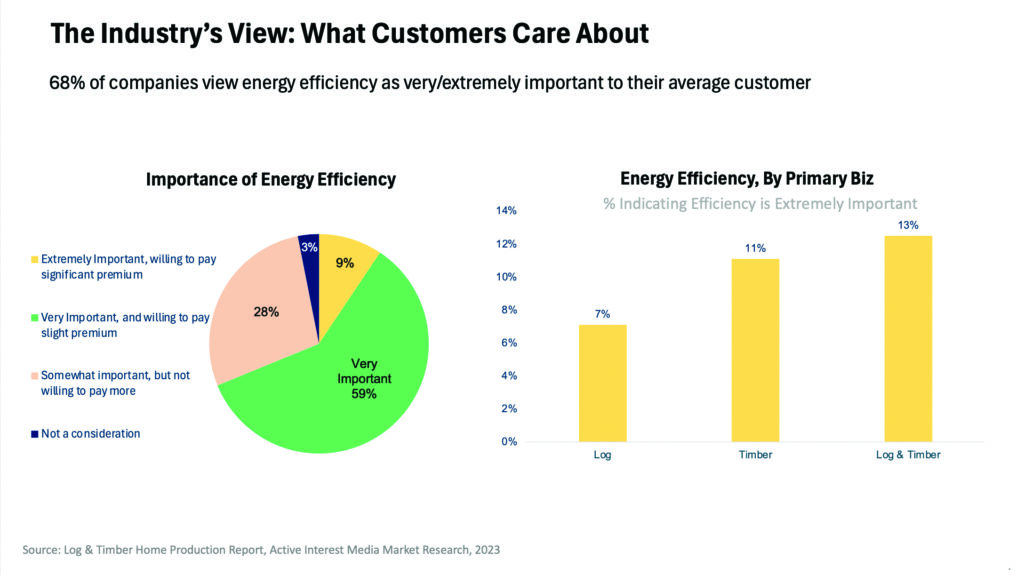

As you can see from the image above, energy efficiency and green building is also ranked very highly (fourth). And 59% of companies report that energy efficiency is indeed ‘very important’ to their customers, such that they’re willing to pay a ‘slight premium’ for it. Only 9% of companies report that it’s ‘extremely important’ to their customers, who are willing to pay a ‘significant premium.’

Note that a total of 68% of companies say that their customers are willing to pay a (slight or significant) premium for energy efficiency, while 31% say they’re not willing to pay a premium for it, including those customers for whom energy efficiency isn’t a consideration. Again, understanding what consumers are willing to pay extra for is important when it comes to marketing a product.

Hybrid Homes

Peak says another interesting result from the most recent survey is the rise in popularity of hybrid homes — ones that employ a variety of construction methods and materials.

“There’s a definite movement away from purism. We survey companies in the industry every other year, and in 2019 and 2021 the biggest group of companies were building traditional full log homes. Now in 2023, there has been a shift from traditional full log homes into hybrid homes that combine logs, timbers, even stick building. People are embracing combining logs with other building materials.”

Photo courtesy of Luke Phillips

One reason for the shift towards hybrid, Peak thinks, is ease of maintenance. “A full log home will settle and there are some things homeowners have to do to make sure it settles properly. Also, as the logs dry over the years, there are some adjustments homeowners are likely to have to make. But if logs are combined with other materials, those issues are lessened when compared to a full log home.”

Ultimately, though, Peak thinks that the most important factor is (again) aesthetics. “Consumers want the natural look and feel of wood — but they want other things as well,” such as a pop of colored paint on drywall.

Photo courtesy of Joseph Hilliard

Budget Issues

Peak advises buyers to be honest about their budget. Customers are inclined to tell manufacturers that they have, say, a budget of $400k, when really, they’ve budgeted for $500k. They’re worried that if they reveal their true budget, the provider will try to spend all that money, and perhaps go a little over.

This is problematic for manufacturers. If a manufacturer works to stay within $400k, then the customer may be less happy with the product than they may have been otherwise. For example, the home might be smaller than they’d like or have lower-grade finishes, just so it can fit that budget.

Of course, they can then choose to upgrade, but that adds time to the project that could’ve been saved if they’d been upfront about their true budget. Instead, Peak recommends that they say something like, “We’d like to get as close to $400k as we can, but we’ve budgeted up to $500k.” Manufacturers should try to earn their customers’ trust, and encourage this kind of honesty, for the benefit of everyone involved with a project.

Zena Ryder writes about construction and robotics for businesses, magazines, and websites. Find her at zenafreelancewriter.com.