New to modular and dealing with reluctant lenders, investors and

insurance providers? Here are some insights that may help.

• If you’re a developer or builder who is new to modular, you may encounter resistance from financial partners. Understanding their concerns about modular is key.

• Good business systems and financials are a must. You should also start with small modular projects, to build a track record.

• Other insights into ways to mitigate modular’s perceived risks and smooth the way with financing partners are outlined below.

As readers of this magazine know, one of the main benefits of modular construction is that, when compared to traditional building methods, it can save time and money. With so much of the building fabricated off-site in a factory, the job gets done more quickly, with fewer workers.

However, if you’re a developer who is just starting to explore modular, you may get resistance from potential financial partners — lenders, equity investors, insurance providers and bonding companies. They will likely have lots of questions that you need to answer in order to build confidence in yourself, your business and your project.

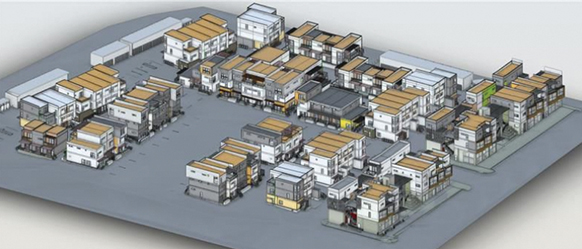

As a developer who has spent 15 years in the modular industry working on 10 different projects — including a $32 million, 21-building, 121-unit project currently underway in Ventura, Calif. — I’ve had to address these concerns. In the process, I have learned how to help financial partners see the advantages in this way of building.

If you’re planning your first modular project, this article offers some broad lessons that might help you. I’ve also included links to more in-depth information at the end.

Lender Concerns

Why are some lenders hesitant to provide financing? They’re not necessarily skeptical about modular — it’s a proven method of construction — but if they haven’t worked with a modular project, or with your company, they will need assurance that you will be successful.

Most of the time, the issue is the developer’s finances and business systems. If the developer doesn’t have a track record of success with modular, if their financials are thin (low capital reserves or inadequate cash flow, for instance) or if they don’t have the bonding and insurance needed to cover the project risk, the lender will likely pass. The perceived risks are too high.

A big point of concern with financial partners is that much of the project cost must be paid upfront to cover the cost of manufacturing, then the finished and already-paid for modules have to be transported over the road. Lenders, as well as other financial partners, need assurance that if the modules they have financed are damaged during transport, they will be adequately insured.

In addition, if the developer hasn’t done a modular project before, the lender will worry that it lacks the knowledge and experience needed to manage the accelerated build schedule.

Smart Small

To overcome this resistance, it’s best to start small. That’s what the company I work for did: our first three multifamily modular buildings had four, six and 15 units, respectively. The successful completion of these projects represented base hits, both for the company and for our lenders. Over time, they helped us build the track record we needed to finance large, home-run projects, like the one we are building now.

Build Strong Partnerships

A developer will also be more attractive to a lender if it has strong, stable partnerships with other companies involved in the project. For instance, we have a close, longstanding business relationship with a company called Completely Concrete Structures, which does all of our flatwork and podiums.

From the lender’s point of view, concrete is a major risk because if the foundation and modules don’t make a perfect fit, the remedy can be costly. Our collaborative relationship with the concrete company, and the fact that they are involved in the project from the earliest design phases, eliminates this risk and makes us more attractive to lenders.

The lesson here is that developers who work as a stable team with the same contractors and subcontractors — that is to say, developers who have embraced a true industrialized construction, or IC, model — are a better financing risk than those that bid out every job and try to cut costs. A good IC team will also get more consistent, better-quality results.

Endure the Extra Scrutiny

Even if the developer has done all of the above, some lenders will still place more scrutiny on modular construction projects than on conventional builds. This can include a more detailed review of the development company’s financials, the quality of the building components and the overall construction plan.

The first time a lender does business with a developer on a modular project, it may also reduce the loan to-value (LTV) ratio, which means the developer must come up with a bigger down payment. (The lender will likely raise the LTV once the developer has completed a couple of successful projects.) Lenders may also want to guarantee the loan with additional collateral, such as the assets of the developer or the project.

Investor Concerns

The down payment and other collateral can be raised from equity investors. The steps that your company took to become a good risk for lenders will also be important to investors, but investors will have additional concerns and will also perform a high degree of due diligence before investing in your project.

The investors we prefer are those who are already committed to industrialized construction and who know what makes a good project. They include institutional real estate investors with a commitment to and a knowledge of IC, as well as investment arms of other developers or institutional investors. Investors look at our company’s financials as well as our corporate structure. They review the construction specifications. They evaluate the modular manufacturer we use, including visits to the factory and analysis of its financials. They also look at the project schedule to make sure we have set realistic targets for each phase.

My company welcomes this type of review because it means there are more knowledgeable eyes evaluating the project. In fact, if you’re new to modular, an investor with experience in industrialized construction using modular methods can be an invaluable partner for the business.

Transport Risks and Insurer Concerns

Another risk you need to address is the possibility (however slight) that modules could be damaged during transport and installation. Lenders and investors will, of course, want you to have enough insurance to cover this risk. (Even with insurance, we have heard of projects where the bank didn’t allow for full drawdown until the modules had been delivered and set, forcing the developer to get a bridge loan.)

However, insurers will also have concerns. They will need proof that you have done everything possible to ensure that the modules will arrive at the jobsite and be set in place without damage.

Questions they may have include the following: Who will be transporting the modules? How long has the transport company been in business? What is their track record? What is their insurance coverage? A transport company that uses technology to track its shipments and document the condition of the modules will be looked on more favorably by insurers and other financial partners.

The same questions will apply to the set crew. Your eventual goal may be to train your own set crew, but on the first few jobs you need to use an experienced company. Otherwise, you may get turned down for financing and insurance.

Bonding Solutions as Risk Mitigators

To help mitigate these risks, bonding solutions can be used to provide assurance that the transportation and installation of the modules will be completed in a safe and efficient manner.

Bonding solutions come in different forms, such as performance bonds and payment bonds. A performance bond guarantees that the contractor will complete the project according to the terms of the contract. A payment bond guarantees that the contractor will pay for any labor and materials used during the project. These bonds can provide assurance to the lender, investor and insurer that the project will be completed as planned and that any damages or losses will be covered.

More to Come

In conclusion, modular construction offers a number of benefits, including cost savings, accelerated project schedule, increased efficiency and improved quality control. However, there are also some challenges that come with financing and insuring modular construction projects. Lenders may be hesitant to provide financing due to a lack of familiarity with this method of construction (and may require a higher level of equity investment), while investors and insurance companies will want to confirm that you have done everything possible to ensure the project’s success and to mitigate any risk.

This article is just a broad overview of the issues involved with modular. Those who need a more in-depth look may be interested to learn that I am co-authoring a white paper on modular financing with a professor at California State University in Sacramento who specializes in construction management.

The white paper will quantify the benefits that developers and builders usually claim for modular, but to which they seldom put numbers — that the time savings of modular results in lower bottom line costs and a higher return on investment. We are in the process of quantifying these benefits via an in-depth look at some of the projects my company has completed.

I expect the white paper to be published sometime in late July of 2023. Readers who are interested can check back at my company’s website: https://www.leapoffaithpartners.com/.

[Editor’s note: Offsite Builder also plans to publish a follow-up article about the white paper and the numbers presented in it.]