A Q&A with insurance expert Edward Fitzgerl

- Adding robots to an offsite factory will increase some risks while reducing others. That means some premiums will go up, while others will go down.

- The need for fewer employees has further insurance ramifications.

- This is a specialized area, so work with an advisor who understands robotics.

Ed Fitzgerl worked for the Lumbermen’s Underwriting Alliance for over 15 years. He’s now a Wood Products Practice Expert and Commercial Lines Advisor at the insurance brokerage HUB International. Specializing in insurance for the wood and forestry industry led him to offsite construction. He’s been working with insurance for offsite construction for over 20 years.

We asked Ed about the insurance implications of introducing robots into an offsite factory.

OB: How does adding robots affect insurance for an offsite facility?

The addition of any asset — including robots — increases the value of your facility. If your insurance provider doesn’t know you’ve added robots, they won’t be able to account for that increase in value. This means you wouldn’t have enough insurance to cover the value of your assets should you experience catastrophic loss, such as a fire.

For example, suppose you remove a manual flooring line where the tools and equipment — nail guns, hammers and so on — are valued at around $5,000. If you replace that manual line with a robotic process, then the value of the line might rise to $300,000. If you don’t let your broker know about the new equipment, and if you have a major loss, you’re grossly underinsured.

If you’re planning to increase your assets, you should let your insurance broker know ahead of time. I do quarterly reviews with my clients. We talk about their plans for the future so we can always ensure the insurance company is okay with those changes and that the client is covered. However, I tell people not to wait for the quarterly review if they are planning a big investment. The sooner your agent knows your plans, the better.

OB: What are the specific implications of adding robots compared to adding assets more generally?

EF: Robots have insurance ramifications that are specific to them. Some factors increase risk and thus the cost of premiums. But other factors decrease them. Also, some insurance carriers simply don’t have enough robotics expertise to be comfortable underwriting them, so if yours is one of those carriers you will need a different one.

It’s important to talk with an insurance expert who knows about insuring robotics. This person can help you sort through all the complications and associated costs and savings.

OB: What are the decreased risks specific to robots?

EF: Adding robots can lower the risk of injury to workers. For instance, you might reduce the risk of nail gun injuries, as well as the risk of back injuries caused by heavy lifting. The amount you save on workers’ compensation premiums may offset premium increases caused by the increased asset value.

If robots help drive down what’s called your experience modification factor, that will drive down your workers’ compensation premium in turn.

Your experience modification factor — or experience mod — is a number that’s applied to your workers’ comp premium. A score of one is the average for your peer group and is good. A score below one is very good, while above one is not so good. Peer groups and experience mods are determined by the National Council on Compensation Insurance. The experience mod calculation is complicated and is based on your past three years of experience.

Roughly, your premium is multiplied by your experience mod. So, if your experience mod is one, you’re even. Your premium is unaffected. If it’s less than one, you’re financially benefiting from your safety program and protocols because they’re reducing your premium. If it’s above one, you’ve got some work to do and should try to get that number down. We can help design safety programs that include training, safety meetings, incentives, and so on.

Workers’ compensation insurance is also based on payroll. So, if by adding robots you’re removing 10, 20, or 30 jobs, your payroll will drop. At the beginning of an insurance policy period you report your estimated payroll for the next 12 months. If that decreases significantly and you don’t tell the insurance company, you will be paying more to the insurance company than you need to during the policy period. At the end of the year, there will be an audit and the insurance company will then refund anything you overpaid — but it’s easier and better not to pay it in the first place.

I do quarterly reviews of clients’ payrolls. So, if you introduce robots and your payroll goes down, we can bring your workers’ comp premium down as well.

OB: What are the increased risks specific to robots?

EF: If I had a facility with even one robot, I would have a pretty beefed-up cyber security program with firewalls and multi-factor authentication in place.

Although I don’t know of any attacks specific to the offsite construction space, robotics are hacked everywhere and all the time. Hackers could install ransomware on your robots, shutting them down until you pay a ransom. Or they could use malware to change or steal the codes on your robots, causing them to malfunction.

Cyber insurance protects you against cyberattacks and the resulting loss of sensitive data. It also covers the cost of restoring robots’ operating software and notifying any third parties affected.

While your robots are shut down or malfunctioning, you’re losing money. So, it’s important to have business income coverage on your cyber insurance policy and to understand what type of cyber events trigger this coverage and what the limits are.

All these items aren’t covered under a typical liability or property insurance policy, which is why it’s important to have a specific cyber policy if you introduce robots.

OB: Any other insurance ramifications?

EF: If a robotic line goes down, more business is lost than if a manual line goes down because robots can work faster than people. Covered causes of loss to a robotic line would include fire, wind, theft, vandalism and mechanical breakdown. These would all trigger business income coverage.

When robots break down, it’s also important to consider the business loss in terms of damaged, or lost, relationships with customers and vendors. What if you can’t get a replacement part? How soon can you get operational again? Could you temporarily hire more employees? Your answers to questions like these are relevant to evaluating the risks and benefits of adding robots. All that needs to be taken into consideration when insuring your facility.

OB: Are any other financial factors to consider?

EF: In addition to lowering workers’ comp costs, reducing the number of employees may also lower the cost of employee benefits such as health and insurance. A cost analysis should compare those savings with the costs associated with introducing robotics.

You can invest the money saved by introducing robots into business innovations and into taking care of existing employees. The latter can include wellness programs, workplace safety efforts, promotions, etc. This will make for more satisfied employees and help with retention.

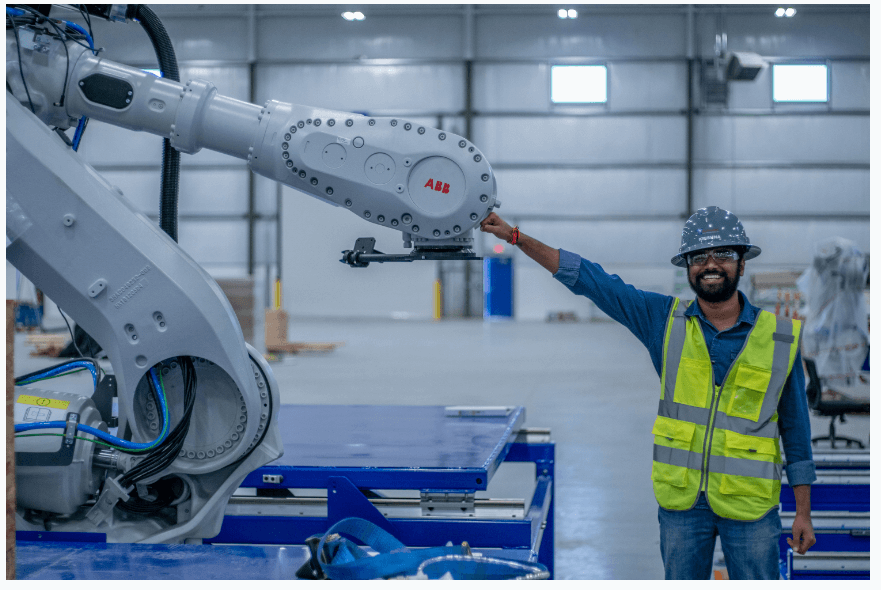

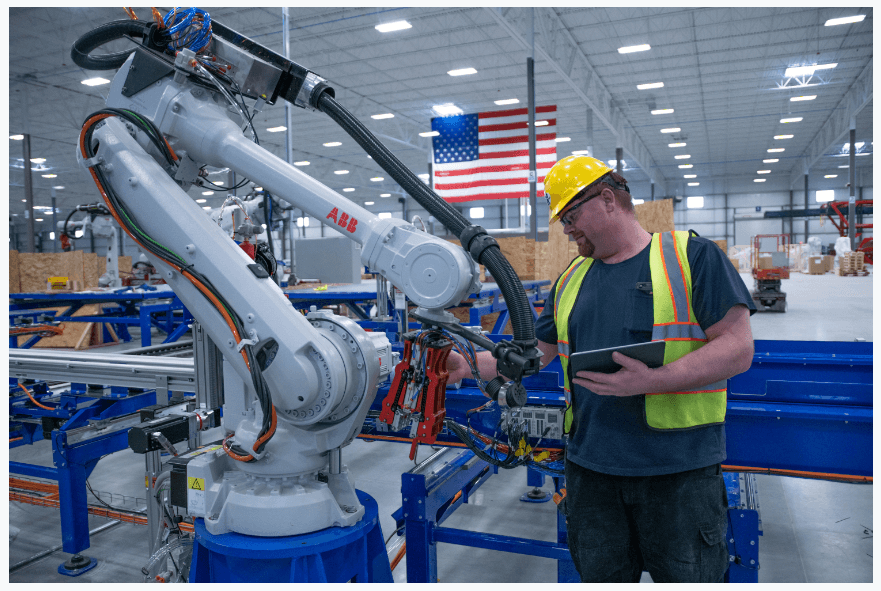

Factory photos courtesy Autovol.