Nine issues that stop builders from switching to modular, and suggestions on how to get past them.

If the modular industry wants to grow, attracting site builders is essential. It’s the most practical route to increasing modular’s market share.

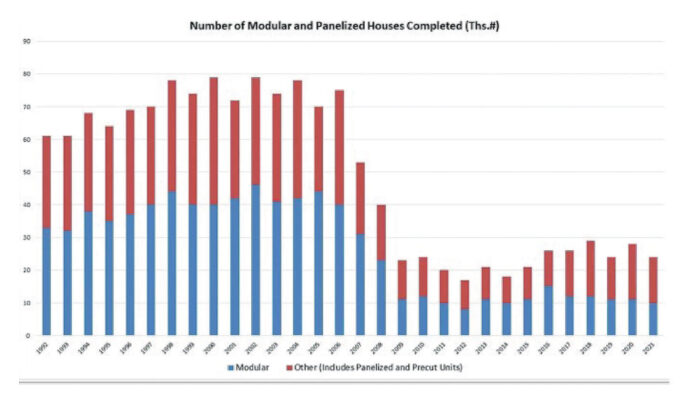

Unfortunately, there’s a long way to go. The total market share of non-site built single-family homes (modular and panelized) accounted for just 2% of single-family completions in 2021, according to an analysis by the National Association of Homebuilders and a Census Bureau Survey of Construction data.

Why haven’t more site builders embraced modular construction? This article looks at both real and perceived hurdles and offers some advice on how to get over them. The information will be helpful to current site builders, or to manufacturers who want to win site builders over to modular.

1. Complex Agreements

Contracts can be a source of anxiety and suspicion. A builder entering into a business relationship is wary from the beginning, especially when given a contract that’s iron-clad and full of legalese. At the outset, the builder accurately recognizes that this “partnership” is one-sided and therefore puts him in a compromised position.

An obvious solution is to move to a simplified contract. That’s what modular manufacturer Westchester Homes, headquartered in Wingdale, New York, has done. Half of the builders it serves were once site builders, according to John Colucci, VP of Sales and Marketing. Westchester won them over, in part, with an agreement that’s roughly two pages long and mostly references the company’s procedure manual.

According to Colucci, Westchester also focuses on establishing a rapport with builders well before any agreement is signed. This is largely an educational process. “The last thing I want to hear from a builder is: ‘I didn’t understand that was my responsibility.’”

2. Unfamiliar Systems

Successful builders all rely on established business and production systems. Those who have made the switch to modular say that it ultimately makes business easier, but that it requires the adoption of systems that can seem cumbersome and counterintuitive at first.

One of these is Dan Mitchell, a custom site builder, modular builder and building systems proponent. As the owner of Eagle CDI near Knoxville, Tenn., Mitchell says “it’s not easy or painless” to learn the modular system and that it took 7-10 builds for his team to become proficient at it. However, in the end there is “less grief.”

He also points out that there may be no need to dive fully into modular, it can be used to augment a site builder’s existing business. “It can enable the builder to serve more people and complete more homes, if managed correctly,” says Mitchell.

Credit: Signature Building Systems of PA, LLC

3. Design Flexibility

Customers expect a certain level of creativity and design flexibility. How can a builder offer those benefits with modular?

The answer is that some manufacturers offer more customization than others, and that builders need to clarify to what extent before visiting any factories. “Only then, should you establish a date for your visit,” says [first name?] DePhillips, a modular industry veteran and consultant based out of Scranton, Pennsylvania.

After that initial visit, builders should evaluate how it went. Did they feel rushed through the process, or were they given an opportunity to ask questions and see flexibility in the manufacturing processes? “If the manufacturer doesn’t live up to your standards, just walk away and start over,” DePhillips says.

Credit: Chief Architect

4. Change Management

Most site builders let customers make changes during the build. That’s more difficult with a modular build, where all decisions are made upfront.

One way to reduce customer change requests is to offer them a tour of the plant while their home is being manufactured. Most manufacturers allow this.

JD Showley, longtime sales representative for Rochester Homes, headquartered in Rochester, Indiana, says that the company hosts customers about four to five times per month. “Most come to the factory to understand room sizes and dimensions. Nearly all come away satisfied with their home, often saying that the room sizes are larger than what they had expected.” He says that only once in a great while will someone want something changed and that’s usually because of a breakdown in communication between the builder and the customer.

Visualization software can also help. Westchester Homes trains its sales representatives in the program Chief Architect, and its sales representatives then train the company’s builder customers. The program’s three-dimensional rendering capabilities enable builders to orient their customers to spatial relationships in their home.

5. Less Vendor Work

Modular construction reduces the number of vendors the builder must deal with. The modular industry markets this as a benefit, with advantages that include easier scheduling and less price fluctuation.

However, this can also cause strain.

Builders have established relationships with lumberyards, framers, plumbers, electricians and other trade partners. Giving a lot of the work to a modular company can be unsettling, especially if those vendor bonds were years in the making. “I believe that what we are asking builders to do, in a sense, is to give up their fraternity brothers,” says DePhillips.

The builder will still need those vendors, but will need them to a lesser extent. DePhillips says that the real challenge is training vendors on the modular process. “This will help them price the work they are doing for you in a more accurate manner.”

Of course, the reduction in site work can also strain vendors’ loyalty to the builder. DePhillips says that the best way to deal with this is to clearly communicate with everyone about the process and the new scope of work, including whether or not the builder will be easing into modular.

“Are you going to use modular to provide incremental sales or are your jumping in feet first and making it your sole source of sales,” he asks. If you’re doing the former, the switch will be easier.

6. Perceived Loss of Control

Builders who are used to taking a hands-on role in all parts of the build can miss that control when turning much of the structure over to a factory.

Dan Mitchell says this represents “old school” thinking. He points out that the builder’s role should be to manage staff and subcontractors. The builder also needs to understand that the factory has quality assurance personnel, and that it uses third-party inspection processes to ensure everything is done correctly and according to code.

In fact, the builder should carefully evaluate the manufacturer’s quality assurance systems during the initial factory visit. “Did you ask questions as to how the inspections and testing processes work?” asks DePhillips. “Did you ask about the company’s service policies and how they handle service should a problem arise? Do they have a full-time service manager? Do they have a full-time service crew, or crews?” (He adds that the plural should scare you a little unless they are a high-volume manufacturer.)

7. Branding Worries

A building company’s identity is tied up in its brand and its reputation is tied to the finished product. Won’t using a modular company hand over control of that finished product?

The answer is that builders still have control over the overall quality and craftsmanship of their homes. But DePhillips points out that maintaining that control means selecting the right modular manufacturer. “You are still the builder. Processes still remain under your control. The difference is that now you have one subcontractor to do much of the heavy lifting.”

Credit: Schumacher Homes

8. Options Management

Some builders don’t want to sell options, preferring instead to send customers to the Ferguson showroom or the flooring store to pick out what they want. That approach doesn’t work for a modular build.

Many modular builders have staff personnel that guide customers through the selection process. They operate like production builders in that they offer a base standard and a limited scope and number of upgrades. Still, some site builders view this as a layer of complexity they would rather do without.

Although this complexity is largely unavoidable, Tim Reese, General Manager of J&J Homes in Charlotte, North Carolina, says it is worth the extra work to sell upgrades. “No builder should have the mindset that optional offerings should be a pass-through and not a profit center,” he explains. “By offering optional upgrades, you are demonstrating value as well as adding margin to your bottom line.”

9. Payment Schedules

Manufacturers want to be protected as much as possible and require a sizable deposit for the home prior to production. They may also demand full payment prior to shipping or on delivery. New modular home builders might consider this a prohibitive barrier to entry, according to John Garrett, owner of Virginia Building Solutions in Tappahannock, Virginia.

“If you are a site builder, you do not have to deal with that,” he says. “Material packages do not have to be paid upfront.”

John Colucci points out that most of the risk is on the manufacturer up until the home reaches the property and is set on the foundation. He says using an assignment of funds from the bank can eliminate the need for the builder to carry the home or use a credit line during that transition period.

In this scenario, the builder is protected through a construction-to-perm loan through which the bank can guarantee payment to the manufacturer against the loan for the package cost of the dwelling after it has been set on the foundation.

It’s an issue of competing cultures. “The manufacturer views it from a wholesale perspective where the customer is nameless and faceless and the home is identified by a serial number,” he says. “Builders are dealing with customers and real-world issues in a retail environment.”

It Comes Down to Training

On a macro level, the solution to all of the above issues is better training and education. “We, as manufacturers, can’t have the mentality to let builders deal with everything on their own,” Westchester’s Colucci says. “We need to support them and give them what they need to sell.”

He says that Westchester Homes offers bi-weekly educational webinars (which average two dozen participants) during which anyone can ask questions about the ins and outs of modular construction. All those registered are sent a recording of the webinar.

What it boils down to is “three things: education, education, education,” Colucci concludes. “As an industry, we have done a horrible job at educating site builders. I think we all need to do a better job at that.”

Reed Dillon is a marketing consultant, freelance writer and owner of Creative Brand Content, in Moneta, Virginia.