Strategic partnerships and cross-industry insights are needed to accelerate offsite and industrialized construction.

- Ankur Dobriyal is a strong advocate of industrialized construction, or IC, which combines prefabrication, automation and regional factory networks to improve efficiency.

- IC growth will require more use of offsite construction. That’s happening and is being aided by interest from the military and government.

- Dobriyal says that more disaster-resilient, energy-efficient homes can be affordably built using IC methods — if permitting and funding improve.

I recently sat down with Ankur Dobriyal, Director of Offsite Innovation at ADL Ventures, a clean infrastructure innovations firm based in Boston, Mass., to talk about the future he sees for the industry.

Dobriyal is tasked with finding ways to implement high-performance, resilient construction into the offsite industry. His long-term vision is to transform the industry using industrialized construction, or IC, methods. IC is the application of industrial manufacturing principles to the building process. It emphasizes the use of standardization, prefabrication and automation to improve efficiency, reduce costs and enhance quality.

He is currently working on a Department of Defense project, as well as on housing affordability for disaster relief efforts. These projects have given him a high-level perspective on the industry, and he believes there are a lot of opportunities to integrate IC into project workflows.

Q: What is your experience with IC, and where do you see it being implemented?

A: My dad was in the Military Engineering Services for the Indian Armed Forces for 35years, so I have been going to construction sites since childhood. He worked on buildings, roads and a few R&D projects, so I had a natural interest in construction.

My main experience with IC was working at Module, a modular manufacturer based in Pittsburgh, Pa. As a team, we designed four standardized plans that could be built using modular or panelized technologies. We began a pilot in November of 2019 that included three of the four designs.

In 2023, we launched a first-of-its-kind workforce and modular housing ‘testbed’ called the Last Mile Lab. Then in 2024, we built a modular manufacturing facility to deliver affordable housing to the region. Our team won the 2023 Housing Affordability Breakthrough Challenge for our Last Mile efforts, and the facility delivered its first modules in October of 2024.

The term Last Mile comes from the fact that Module [will eventually be just one piece of] a much larger industrialized construction network. When complete, the network will include a central headquarters that manages the design process, as well as the supply chain and project pipeline. There will be several regional factories closer to where the homes will be needed. These regional factories will carry out assembly and final delivery. Module’s factory is the first one.

Photo courtesy of: Module

Q: An IC infrastructure requires more market adoption of modular and other prefabrication methods. Is adoption growing?

A: The military already knows about industrialized, offsite, modular and prefab construction methods, which is why we’re working with them. Interest in these methods is also growing across the government more generally.

It’s not just government, though. The fact that offsite methods have been around for a hundred years is finally working in our favor. We seem to be approaching a critical mass in terms of awareness and adoption across the building industry in general.

People who understand offsite understand that the first one or two projects they do will be a learning curve. They also know that once they get over the initial hump, it’s going to be a better way to build.

As interest in offsite grows, we’re seeing more influence from other industries as well, including robotics, aerospace, automobile and shipbuilding. Adamares, a Finnish company with roots in the shipbuilding industry, is planning a 2.5 million sq. ft. modular housing factory in Waycross, Georgia, with construction scheduled to begin in late 2025.

These developments are part of the necessary R&D we need. We need fresh ideas from people who have been successful in manufacturing for other industries and can apply that knowledge to building.

Q: You’re working on a pilot project in response to last year’s flooding in North Carolina. What disaster-resistant features will those homes incorporate?

A: The North Carolina pilot is part of a larger effort through the Economic Development Administration (EDA)’s Tech Hubs Program. That program aims to drive regional growth in offsite housing construction.

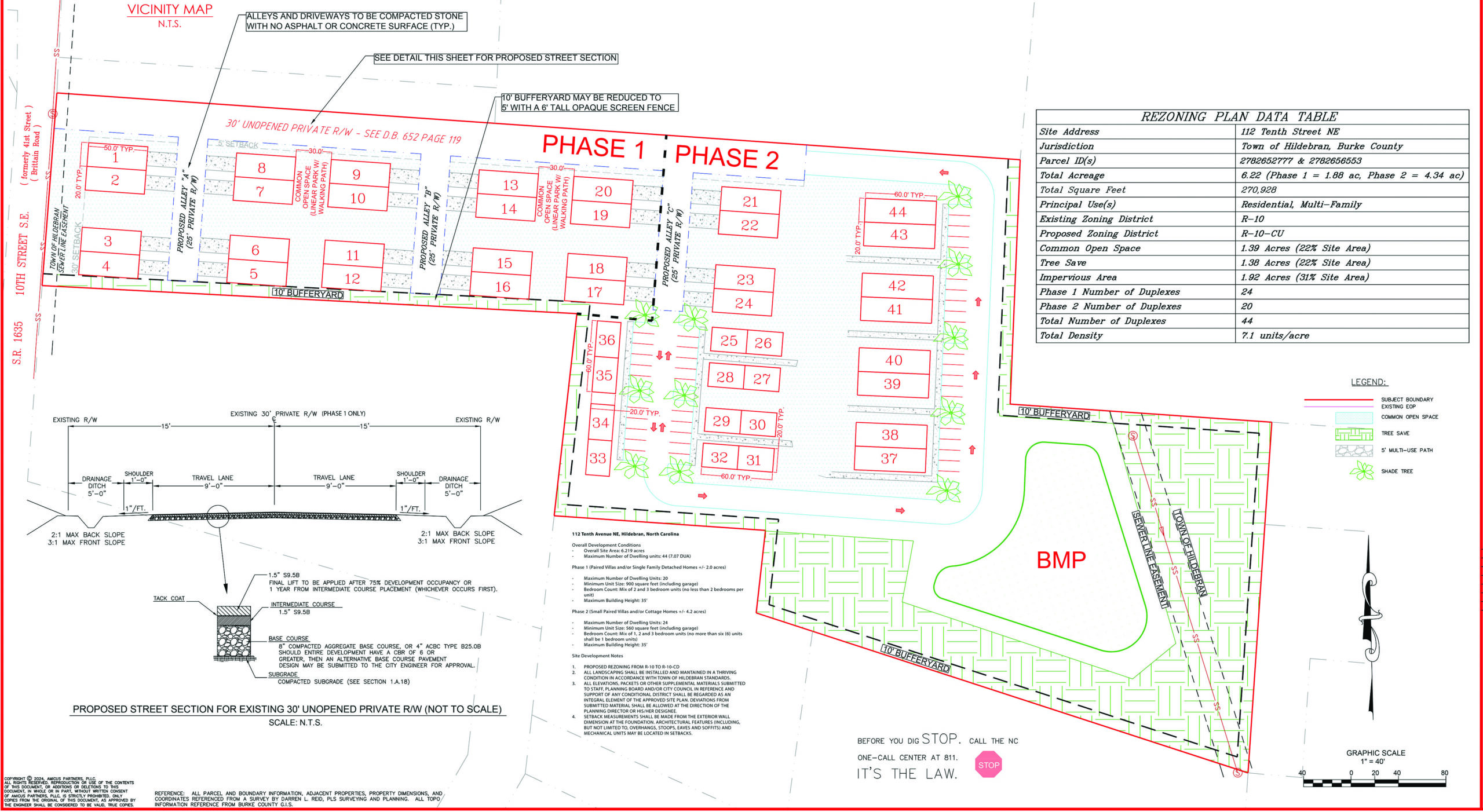

It will have 44 homes built with a mix of modular and panelized methods. They will be built to the Insurance Institute for Business and Home Safety (IBHS)’s Fortified Home standard for resiliency. Some of the homes will be offered specifically to survivors of Helene, the tropical cyclone that hit the Southeastern US in September of last year.

The homes will also follow the energy efficiency standard set by System Vision, a program developed by Advanced Energy, a North Carolina-based nonprofit energy consulting firm. The program guarantees energy savings and comfort in affordable housing, and we expect the homeowners’ energy bills to be as much as 50% less than in traditionally built homes of similar size.

The general contractor is Howard Building Science. They’re based in Granite Falls, N.C. and focus on providing missing middle housing.

For the modular units, Howard is working with Cardinal Homes, a modular homebuilder based in Wylliesburg, Va. (The first home is scheduled to be set and finished by August 2025.) We’ve also been talking to a few modular and panelized manufacturers about incorporating Fortified Home specs into their designs and, surprisingly, it doesn’t cost as much as people may think.

Photo courtesy of: ADL Ventures

Q: How much will the Fortified standards add to construction costs?

A: The homes on this pilot project might end up being three to five percent more expensive to build. But if we can build this way at scale, that number should come down to one or two percent — ifthe home is built with offsite or prefab methods.

That could be a bargain when compared to the savings you might receive on an insurance premium. The numbers will vary by region, however: South Carolina residents can get 50% discounts on the wind portion of their insurance; Oklahoma residents, 40%. IBHS also claims that, in some locations, a Fortified Roof designation could reduce annual insurance premiums by $791 to $1,533. (FortifiedHome.org lists incentives by state.)

Q: What can industry players do to increase offsite’s market penetration?

A: Most industry interventions have been local — an example is Module, which is focused on the Pittsburgh region — but these efforts don’t provide a lot of momentum in terms of innovation. A regionwide effort would be more likely to make a big impact. This could include a state or Federal government agency looking at all of its activities on the building side.

Q: What kinds of financial help can developers of affordable and workforce housing take advantage of?

A: A lot of people trying to raise money on the housing side only look at money that’s available for housing. That’s a mistake.

If you’re building housing, it’s not just about housing. You also need to train people to build those homes, so you should be looking for money that’s out there for workforce hiring and training. There are also other programs that will provide incentives for housing. Electrification programs are one example. Some states look for more energy-efficient construction because it will be less intense on the grid.

The key here is to look at these and other facets that apply to your project. If you’re in housing, chances are there’s probably five programs, which, at first glance, don’t seem to be housing-related, but can provide funding to you.

Q: What’s the current regulatory landscape, and what needs to change to move offsite and IC forward?

A: The lowest hanging fruit is permitting and approvals. Most states govern offsite methods at the state level so we’re having to get permits when the work is being performed in the factory, and then again on-site. Sometimes they overlap, sometimes they don’t. Some states are better with reducing the redundancies, but for most states you have to get permits in both places. Updating these regulations would allow us to build faster.

The other area where better policy would help is financing. Like I said, housing affects a lot more things than just housing. If there are policy changes that support offsite construction, that will give funders and insurers more confidence. Both are risk-adverse, and if they see a risk of policies slowing down adoption of a particular technology or building method, they’re going to categorize it as high risk.

Policymakers can incentivize offsite adoption by [streamlining regulations] and by reducing the number of permitting hoops builders need to jump through. Currently, not enough of that is happening.

I encourage people to get involved with their regional policymakers and help shape the future for offsite construction. Our expertise is needed to address policymakers’ concerns and to help remove perceived barriers.

Heather Wallace is a freelance writer and industry engagement specialist with over two decades of experience in various areas of the building industry. She has covered topics on construction, technology, workforce development, green building, and sustainable living.