What current trends and influences do builders and developers need to be aware of?

- Although building homes in a factory can make it easier for builders and developers to provide the features that buyers want, challenges remain.

- ‘Builders’ insistence on upgrades often results in lower profits.

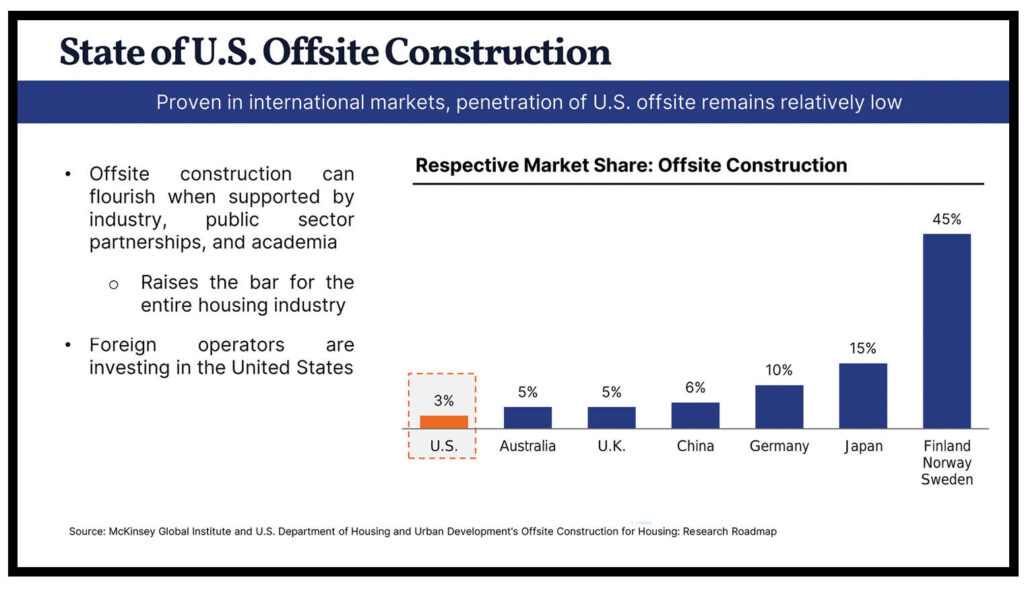

- As more big builders use offsite to further their vertical integration, more regional builders are doing the same.

Margaret Whelan is the Founder and CEO of investment bank Whelan Advisory Capital Markets (Whelan Advisory). Her company provides investment banking and financial advisory services to many types of businesses in the construction industry, including both conventional and offsite construction companies. No surprise then that Whelan and her team keep a close eye on trends across the entire construction industry.

In October 2023, Whelan and Currey Cornelius, a Managing Director at Whelan Advisory, gave a presentation at the National Association of Home Builders (NAHB)’s Building Systems Summit in Washington, DC, in which they outlined the forces — positive and negative — currently influencing the offsite construction industry.

In this article, we’ll not only dive into the themes of that presentation, but also expand upon them further with some additional insights they shared with us.

Wish Lists

Whelan believes there are three major trends currently underpinning homebuyer demand, and she believes these trends favor offsite construction:

1. ‘Well’ buildings. These are buildings that promote health by ensuring clean interior air. They feature the use of non-toxic materials such as formaldehyde-free flooring and paint with low to no VOCs (volatile organic compounds), as well as effective fresh air ventilation and filtering.

Buildings with these features are typically high-quality structures and Whelan says that offsite construction tends to result in “higher quality buildings with better design.” She says that the quality and design enhancements are thanks to continuous process improvement, “which is not possible in the field.”

2. Automation and connectivity. Many consumers want homes with lots of automation. For example, in addition to automated lighting and heating, Whelan mentions, “They want to be able to turn on the air conditioning while on their commute, so the house is cool when they arrive home.”

They also want connectivity that lets them see (from work, for example) when a package has been delivered to the home. Whelan says offsite is particularly suited to this trend because of its “ability to add infrastructure efficiently and in a quality manner in the controlled factory environment.”

3. Resilience. Whether their home is in the hurricane-prone Southeast, or at risk from earthquakes on the West Coast, homebuyers want it to withstand what nature throws at it. According to Whelan, offsite-built homes are “more resilient given that they are built to quality specs in a controlled environment.”

She says that “the opportunity is there to put all three of these trends together and offer a fully baked solution to the consumer.”

Small and Affordable

In response to affordability challenges, there’s also a trend towards smaller homes, which again favors offsite construction — specifically modular construction. Modular is naturally suited to smaller living spaces, because of the limitations on road transportation and the lifting capacity of cranes.

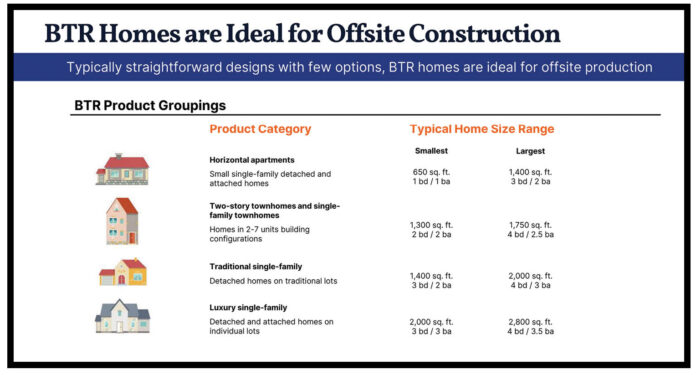

Another growing trend is build-to-rent (BTR), which is also ideal for offsite construction, Whelan says. This is because companies that want purpose-built rental homes are typically looking for straightforward designs with few options. Unlike the custom home market, they want efficiency and the cost effectiveness of repeatability. They also want energy efficiency, which includes tight building envelopes, which offsite construction — with its greater precision — is well-placed to provide.

Whelan acknowledges that conventional builders do tend to have a higher gross margin on upgraded products. But she cautions that conventional builders often “prioritize sales and marketing and being able to differentiate their product by offering too many options and upgrades.”

A focus on options upgrades can actually lower profits. For one thing, the time needed to add these options means the home takes longer to get to market, which means builders often don’t get the returns they anticipated. In addition, the availability of numerous upgrades means that less customized options tend to be devalued by consumers who then pay less for them.

Whelan admits there’s not as big a gross margin on build-to-rent homes for manufacturers, but because the product is simpler (i.e. there are fewer options for customization), a manufacturer will spend less time and manpower on sales, while also gaining the speed advantages of repetition. And it’s repetition that’s really needed, Whelan believes. “In BTR there’s no need for options, because the owner is an institution who will never live in the home, not a homebuyer building their dream home.”

Labor Woes

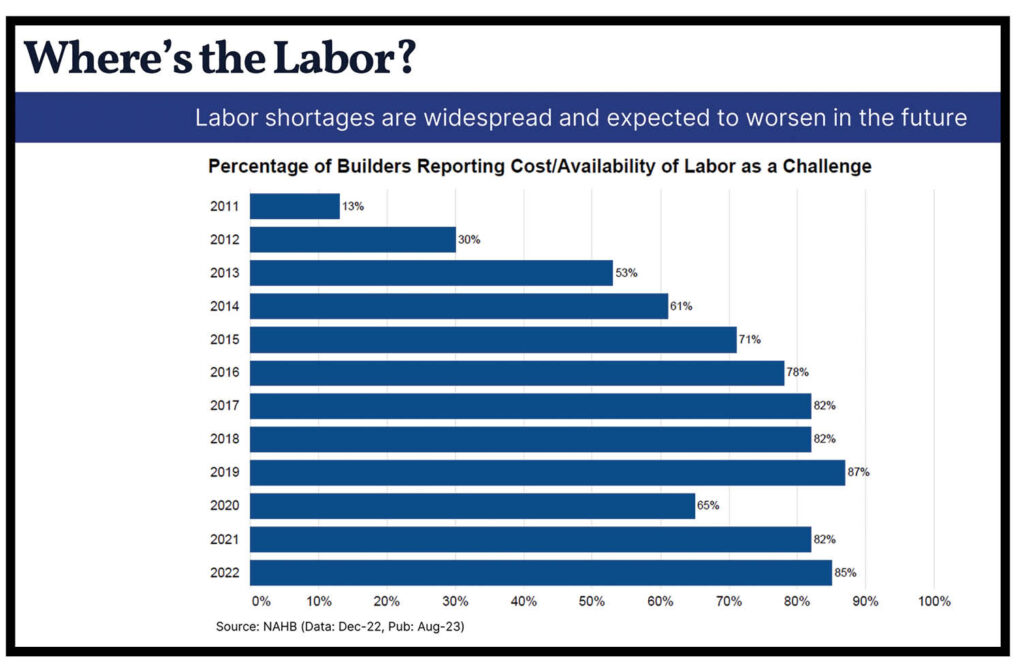

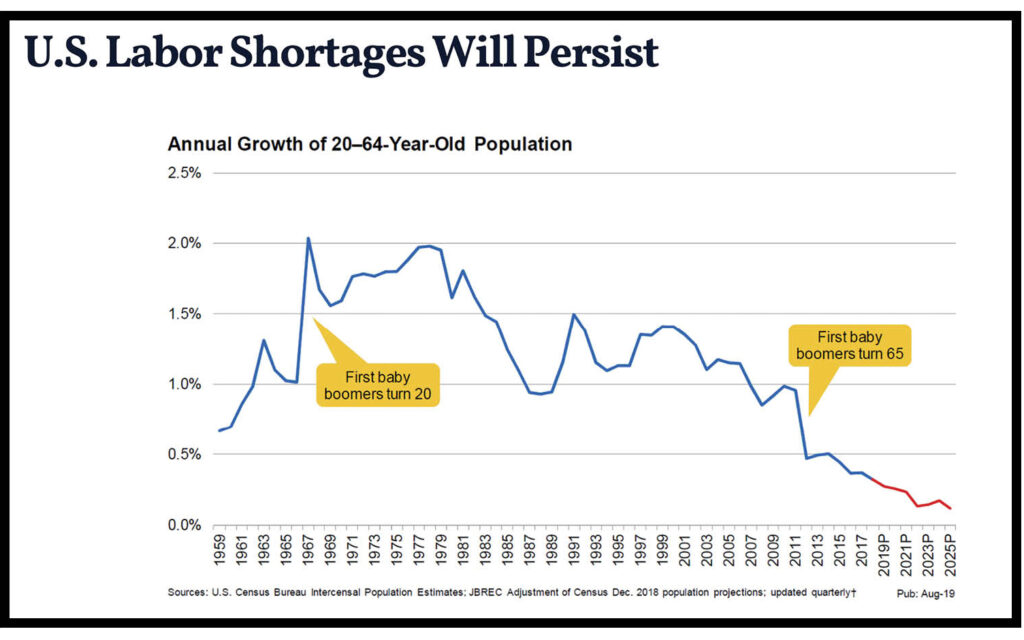

Cornelius says, “It’s well-known that the average age of construction workers has been going up and it’s now in the 40s.” Indeed, according to NAHB, the median age of construction workers across the country is 42. The states with the oldest median age are Maine and Vermont, where it’s 47.

As well as the aging of American workers, there are also fewer Mexican immigrants available to work on jobsites. “And it’s not just because they’re working in Amazon warehouses. It’s a generational shift,” Whelan says.

To solve the problems of older and fewer available workers, “We can try to attract young people to work in the trades and/or we can reduce the need for labor — with automation,” Cornelius says. Automated, precision manufacturing reduces labor needs in two ways: in the performing of the initial work and by reducing rework, which is fixing or adjusting the work of the person who performed it before — which isn’t uncommon on a traditional jobsite.

Although there are robots that operate outside — when 3D printing, for example — offsite construction is more naturally suited to automation. In addition, when it comes to attracting and retaining workers, offsite construction also has potential advantages including a comfortable indoor working environment, equipment that results in less wear and tear on the body, a consistent location, among others.

Persistent Challenges

While these advantages are compelling, there are also a number of challenges for offsite construction. Cornelius lists the following:

Capital needs. It’s expensive to get a factory set up with all the necessary equipment and technology.

Overhead expenses. A factory and its employees are fixed expenses that need to be paid for, even during a slump.

Limited delivery radius. Road transportation is expensive, so there’s economic pressure to reduce the distance between factory and site.

Inconsistent codes/regulations. Every time a manufacturer moves into a new geographical market, they must learn new regulations and adapt their products. “They also have to understand the local process to being code compliant,” Cornelius says. As an example, he mentions Fading West, a manufacturer based in Buena Vista, Colorado (about 100 miles west of Colorado Springs). “Regulations in that state can vary by county to a wide extent and can cause major delays.”

Lingering stigma. Even though offsite construction has been around for a long time some consumers, and even some industry people, have questions about its quality.

Loss of operators. The recession that started in 2008 put many offsite manufacturers out of business and the industry still hasn’t recovered.

However, despite these challenges, major homebuilders are embracing offsite construction through vertical integration. For example, PulteGroup acquired ICG, Toll Brothers formed TIS (Toll Integrated Systems), and NVR formed a Building Products Division.

And it’s not just big national companies that are moving into offsite. Cornelius says plenty of smaller, regional builders — for example, Van Metre in Virginia — are starting their own manufacturing operations, despite the lower capital they have available. These companies have looked at the benefits and opportunities, and have concluded that they outweigh the drawbacks and challenges.

Zena Ryder writes about construction and robotics for businesses, magazines, and websites. Find her at zenafreelancewriter.com. All images courtesy of Whelan Advisory.